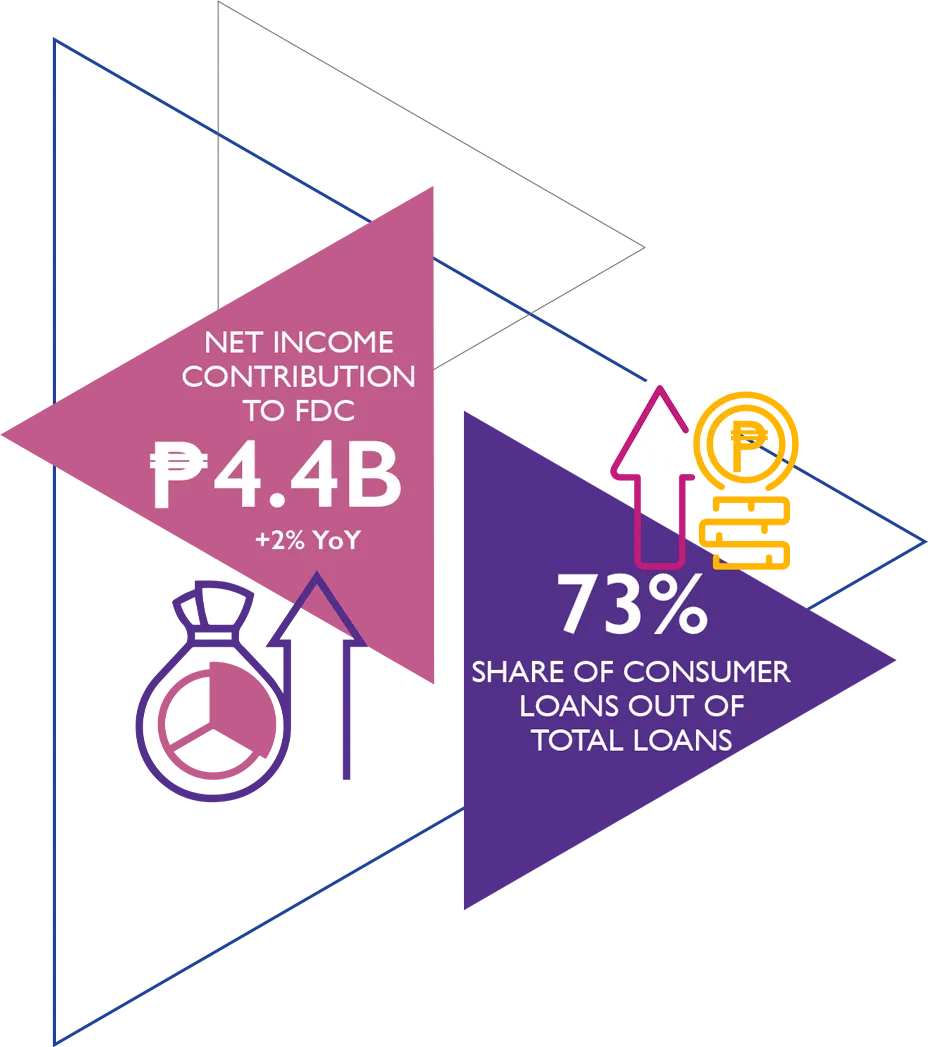

“The steady increase in the levels of loans and securities

has increased the earning capacity of the Bank to almost

back to pre-pandemic levels.”

EastWest Bank

delivered a net income contribution to FDC of P4.4 billion

in 2022, higher than the P4.3 billion the previous year. Net

income surged by 42 percent excluding the one-time gain from

the sale of its hold-to-collect investments in 2021.

“One of Filinvest’s key engines of growth is its extensive

residential land bank of almost 1,900 hectares and

commercial land bank of 574 hectares.”

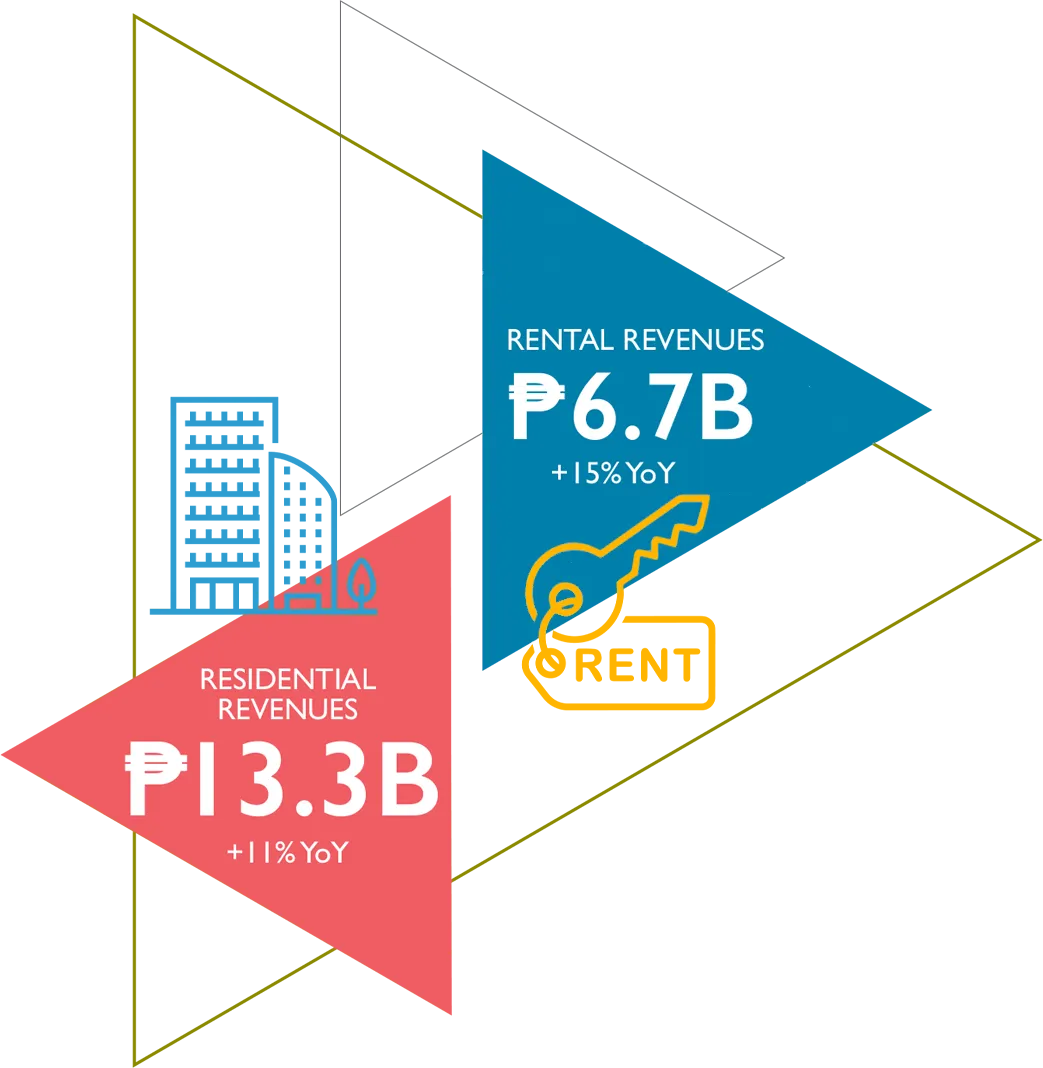

FDC’s

real estate business contributed P4.9 billion in net income

before tax to the group in 2022. Revenues from the

residential segment rose by 11 percent to P13.3 billion due

to accelerated construction progress. Reservation sales grew

by 13 percent to P18.0 billion as new projects were

launched. Revenues from malls and office rental improved by

15 percent to P6.7 billion. FLI launched seven new

residential projects in 2022, valued at P5.9 billion.

“FDC is also focusing on expanding and diversifying the

portfolio to strengthen the renewable energy offerings.”

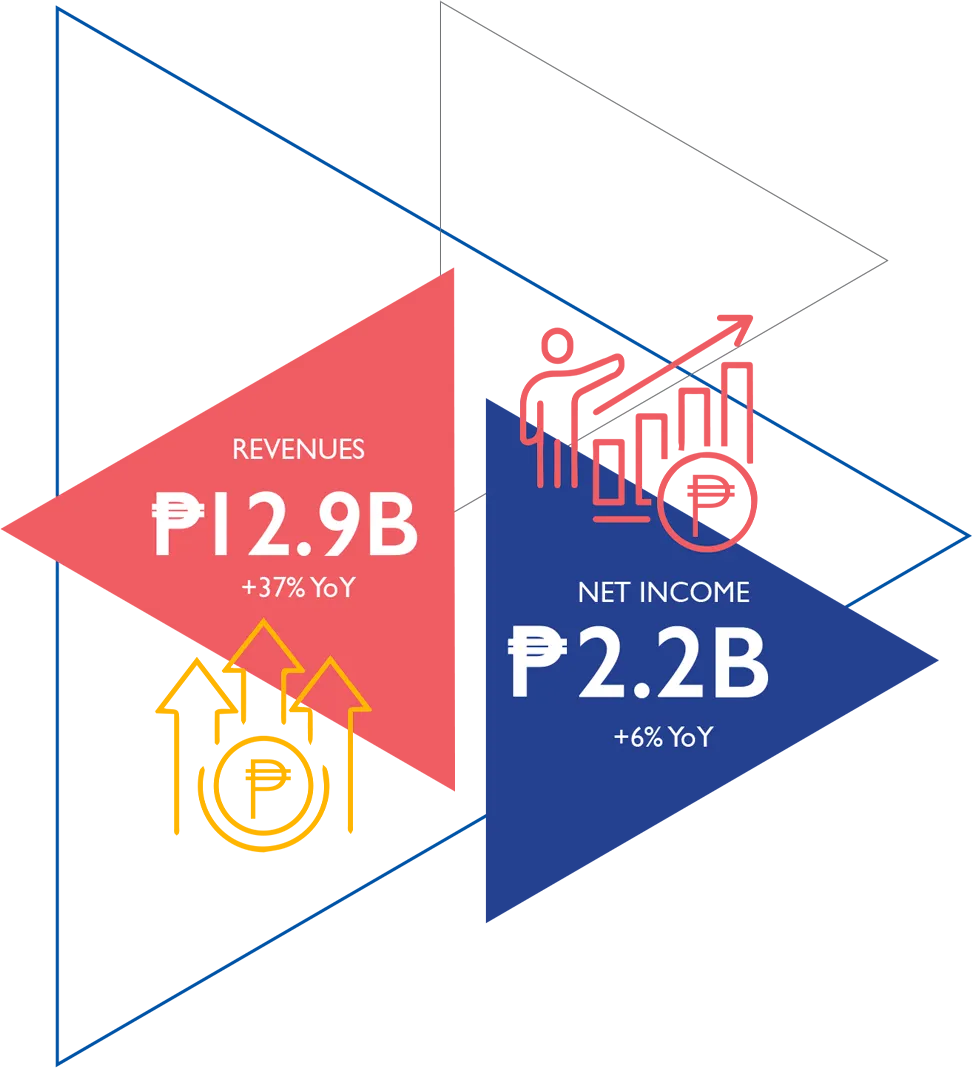

FDCUI

contributed P2.2 billion to FDC’s net income in 2022,

growing by 6 percent from the previous year. The net income

growth was driven by the rise in revenues by 37 percent to

P12.9 billion on account of higher pass-through cost of

fuel.

New wins in 2022 include the 3.4-MW biomass

contract under the government’s Green Energy Auction

Program, in close coordination with the Cotabato sugar

plant.

“FDC remains committed to help build the tourism sector

driven by the belief that the Philippines has so much to

offer in natural beauty, experiences and hospitality.”

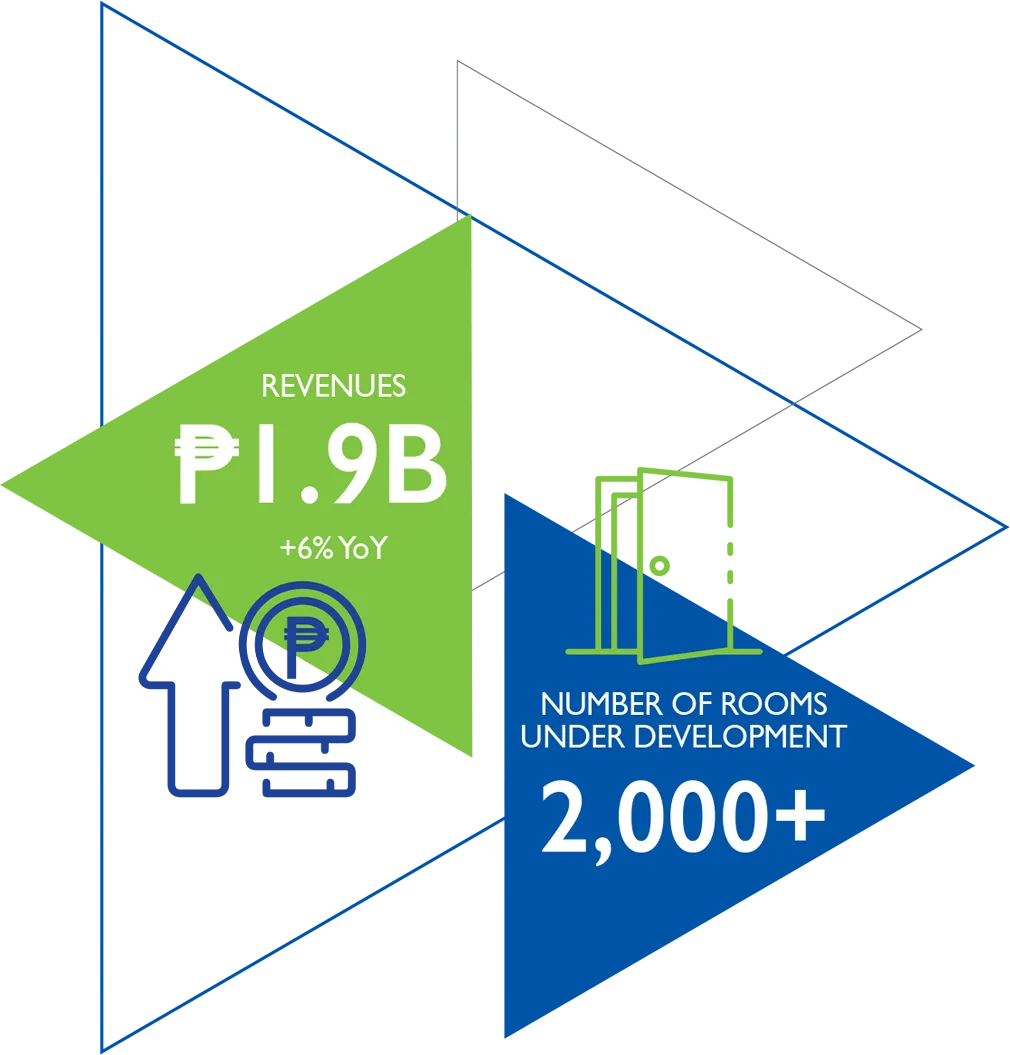

Hotel

operations saw a rebound in revenues of 60 percent to P1.9

billion in 2022 buoyed by the steady resurgence of tourism.

Average room rates increased across all the properties while

occupancy rates were higher for Crimson Boracay as well as

Quest in Cebu and Tagaytay.

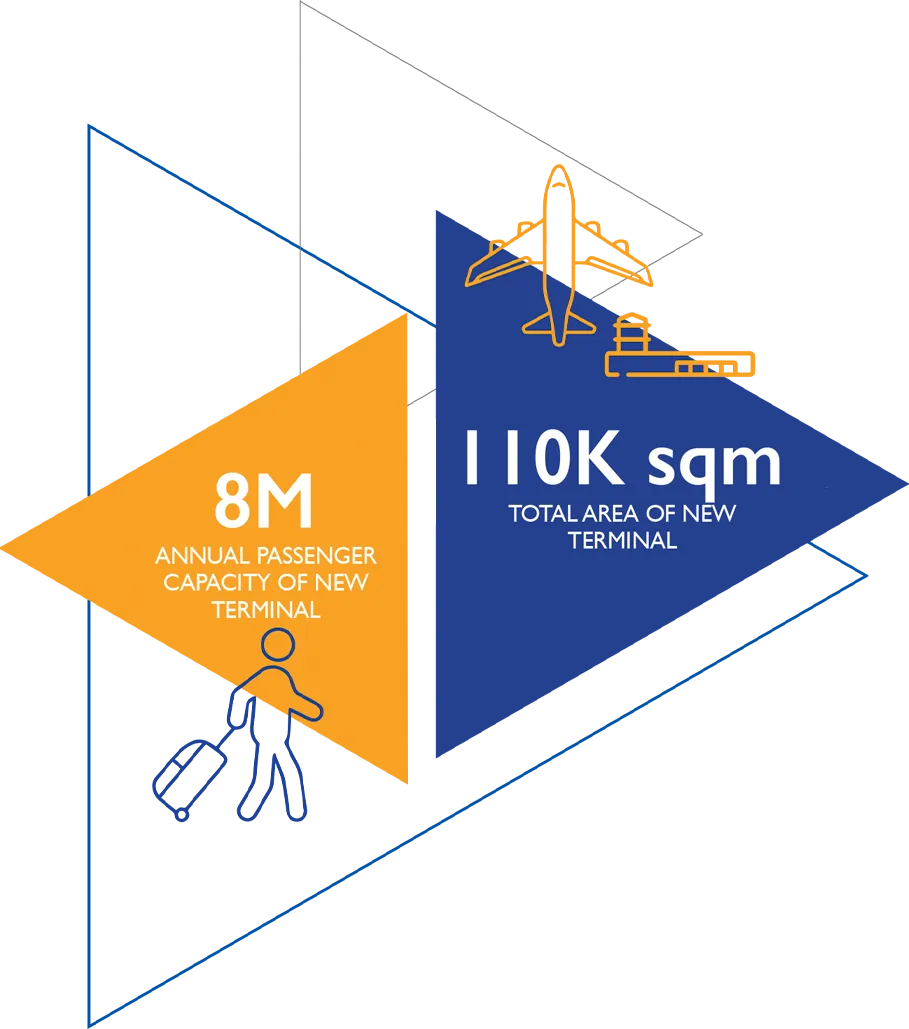

“Our vision is to transform Clark Airport City - a complete

urban destination where people can work, eat, shop and stay

within a five-minute distance from the airport.”

FDC’s

ownership interest in LIPAD is 42.5 percent while the other

consortium members are JG Summit Holdings Inc., Philippine

Airport Ground Support Solutions Inc. and Changi Airports

Philippines (I) Pte. Ltd., a wholly owned subsidiary of

Changi Airports International. Together with FDC’s vast

experience in property development, the consortium members

bring their expertise in air transportation and airport

operations.